Only three companies have ever surpassed the $3 trillion market capitalization threshold: Microsoft, Apple, and Nvidia. While we are all aware of the big giants Microsoft and Apple, that have been justifying this valuation, the semiconductor bellwether Nvidia has recently joined this elite group and jostling for the top spots. The company’s share price has accelerated more than 160% since the beginning of 2024 and 780% since January 2023. Interestingly, the shares took less than 100 days to reach market capitalization of $3 trillion from $2 trillion.

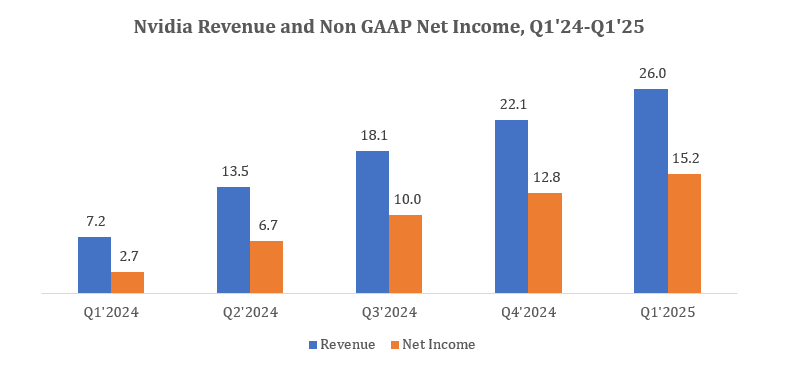

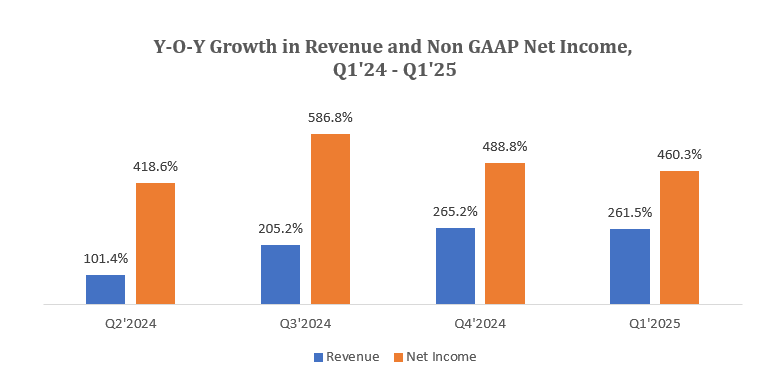

Nvidia reported a stunning financial performance over the last few quarters

NVIDIA has experienced exceptional growth in the past few years, and it would need continued expansion to maintain its stellar returns. In Q1, 2025, the company’s revenue increased 261.5% to $26 billion and non-GAAP net income surged 460.3% to $15.2 billion. In fact, it has reported triple-digit growth in both revenue and net income for the past four consecutive quarters.

What is driving Nvidia’s Valuation?

Nvidia began its journey as a GPU design and manufacturing company, to enhance the image display for computers that later revolutionized the gaming industry. These GPUs could perform a magnitude of mathematical calculations simultaneously, through parallel processing. They were capable of rendering complex and lifelike pictures, making them indispensable for gaming industry. With its high computational power and parallel processing capabilities, these GPUs eventually became the processor of choice artificial intelligence (AI) applications.

The company has been capitalizing on the accelerating demand for AI chips, that have become the cornerstone for gaming, automobile and technology companies. Over the past few years, the demand for Nvidia’s AI data centre graphics processing units has soared, driven by the biggest tech companies, who are in a rush to develop the robust computing infrastructure needed to deliver powerful AI solutions at scale. According to a report from CB Insights, Nvidia currently holds 95% of the GPU market for machine learning. Its AI chips, sold as both a standalone component and in systems designed for data center, are sold for a minimum of $10k each.

Not to mention, ChatGPT was trained using 10,000 of Nvidia’s graphics processing units (GPUs) clustered together in a supercomputer belonging to Microsoft.

Nvidia’s CEO Jensen Huang says: “With our innovations in AI and accelerated computing, we’re pushing the boundaries of what’s possible and driving the next wave of technological advancement.”

The company announced the H100 processor (Hopper) in March 2022. Later, in March 2024, the company released its Blackwell chips, which is twice as powerful as the current generation of chips for training AI models and offer five times the performance on “inference” (the speed at which such models can respond to queries).

It expects to record massive revenues in FY2025, from its Blackwell chips, and is already on a wider growth path with its plans to roll out newer and powerful chips next year. Notably, the company has its plans to launch Blackwell Ultra in 2025 and a new AI chip platform called Rubin in 2026.

Who is buying Nvidia’s Chips?

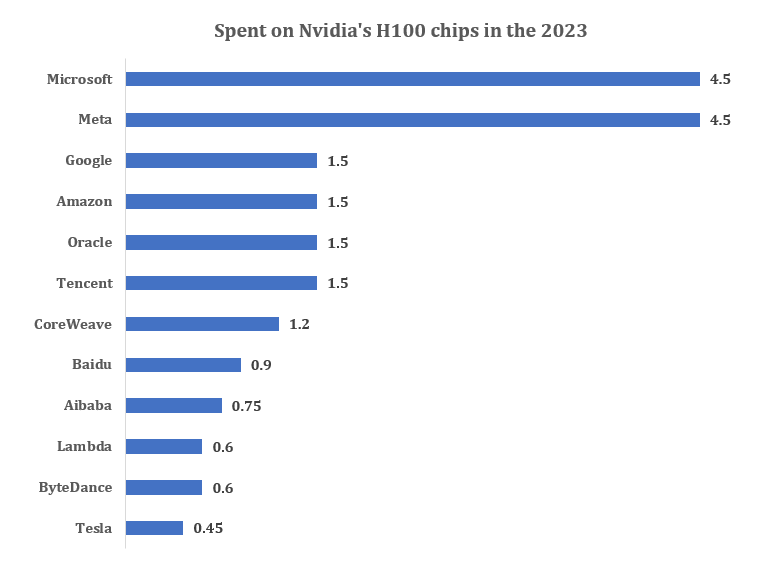

Microsoft and Meta were the two of the largest buyers of Nvidia’s H100 chips in 2023. According to a report by financial services firm DA Davidson, these two tech companies spent a combined $9 billion in 2023.

The company’s CEO, Jensen Huang believes that the demand from other tech giants and other players in AI space would continue to contribute to its revenue. He stressed that the demand for both the Hopper and Blackwell lines was “way ahead of supply”, and it will continue “well into next year”.

However, other tech players are actively challenging Nvidia’s dominance. As per the reports, the big tech giants including Microsoft, Google, Amazon, and Meta have already embarked on developing their own AI chips, to reduce their reliance on Nvidia and trim the cost of developing AI models. Moreover, Nvidia faces limitation in chip production due to its reliance on Taiwanese manufacturer TSMC for chip assembly. With only one manufacturer actively involved, the lead time for manufacturing these cutting-edge chips extends to several months. This is one of the reasons that the tech giants have resorted to design their own chips.

In Sep 2023, Amazon announced to invest up to $4 billion in Anthropic, a San Francisco start-up working on artificial intelligence. While Nvidia sold 2.5 million chips in 2023, Google spent $2-3 billion building about a million of its own AI chips. Amazon also spent $200 million on 100,000 chips and Microsoft has started testing its first AI chip.

How do investors perceive Nvidia’s rising share price?

Based on the company’s impressive current financial performance and forecasted numbers, Nvidia’s forward price-to-earnings ratio stands at 49.26. This is way more than the S&P forward PE ratio of 21.94, as per the estimates from Ycharts. This indicates that Investors are expecting higher future growth from the company, leading them to pay more for its earnings compared to the average company in the S&P 500. This also reflect strong investor confidence and a favorable market sentiment towards the company.

This optimism comes from the rising interest in generative AI, with 2023 being a breakout year. According to Gokul Hariharan, Co-Head of Asia Pacific Technology, Media and Telecom Research at J.P. Morgan, “Generative AI reduces the money and time needed for content creation — across text, code, audio, images, video and combinations thereof”. The emergence of generative AI holds the potential to drive innovation and open up new avenues for business models and applications. While tools like ChatGPT are trained on diverse data, companies are increasingly developing specialized generative AI systems tailored to specific industries and datasets.

According to research by J.P. Morgan, Generative AI could increase global GDP by $7–10 trillion, or by as much as 10%. The demand for computational power is soaring with generative AI applications like ChatGPT. According to research by Gartner, the AI chip market is projected to more than double by 2027, to roughly $140 billion. This trend not only benefits the software industry, but also the hardware companies with robust AI related supply chains. These factors are expected to sustain AI demand well in 2024 and beyond, thus provide a more powerful breeding ground for Nvidia.

What does the future hold for Nvidia?

Although Nvidia’s primary revenue currently stems from AI, data centers, and gaming, the company has also been exploring other markets with significant potential. One notable area is the automotive segment, where Nvidia develops solutions for the self-driving car market. While this market is still in its early stages, its growth could indeed be a game-changer in the future. As the autonomous vehicle industry matures, Nvidia’s expertise in AI and hardware positions it well to play a pivotal role in shaping the future of transportation.

Other than that, Nvidia is also making significant strides in the field of medical imaging industry. Nvidia will leverage its GPU technology for several critical healthcare applications, like automating image analysis, reconstructing images, and enhancing diagnostic accuracy, by supporting radiologists and pathologists.

Authored by Ekta Bhatia for Fujn